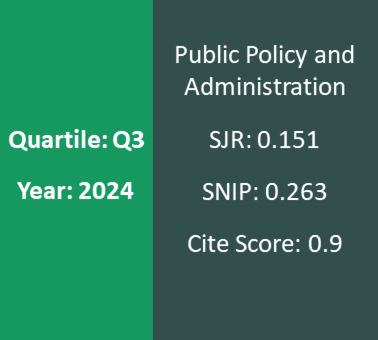

De-Shadowization of Tax Gaps in the System-Compositional Models of State Fiscal Policy: Comparative Analysis of EU Countries and Ukraine

DOI:

https://doi.org/10.5755/j01.ppaa.20.3.28595Keywords:

tax burden, tax revenues, income tax, budget and tax sphereAbstract

The purpose of the article is to consider the empirical calculations of the level of de-shadowization of tax gaps in the system-compositional model of the fiscal policy of the state. The methodological approach to cointegration of the level of de-shadowization of tax gaps into the system-compositional model of fiscal policy is substantiated, taking into account the strategic determinants of financial and economic development of the state. The method of calculation of the integrated indicator of strategic alternatives is presented and represents the configuration of the modified system of fiscal innovations in relation to the taxation of economic entities. A methodical approach to estimating the level of de-shadowization of the tax gap on the income tax of economic entities is proposed. The level of unit testing of variables of de-shadowization of tax gaps from indicators of financial and economic development of the EU and Ukraine is analyzed. It is concluded that one of the most influential factors today is the de-shadowization of the economy. The future directions are the research of the ways to improve Ukraine’s fiscal policy.